Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Global Self Storage hit record revenues of $3.2 million in Q3 2025, up 0.8% from last year. Same-store occupancy jumped 1.7% to 93.2%, leading all US self-storage firms.

This beat bigger players like Extra Space Storage and CubeSmart, who saw flat sales or falling occupancy. The smaller operator showed how smart pricing and good customer care can win in a tough market. Self-storage demand picked up late in the quarter across the Northeast US.

Global Self Storage grew total revenue 0.8% to a new high of $3.2 million in Q3. Same-store sales matched this gain thanks to higher occupancy and steady rents per square foot.

Net operating income rose 3% to $1.9 million. Funds from operations per share climbed 12.6% to $0.11. The company runs 13 stores with 820,000 rentable square feet in New York, Pennsylvania, and Connecticut.

Average monthly rent per occupied square foot rose 1.6% to $15.95. This shows strong control over self-storage rental rates and space use. Smaller self-storage operators often move faster than big chains.

Global Self Storage led with 93.2% same-store occupancy, up 1.7 points year-over-year. Extra Space Storage held steady at 93.7% end occupancy but saw flat same-store revenue. CubeSmart dropped to 89.0%, down 1.2 points

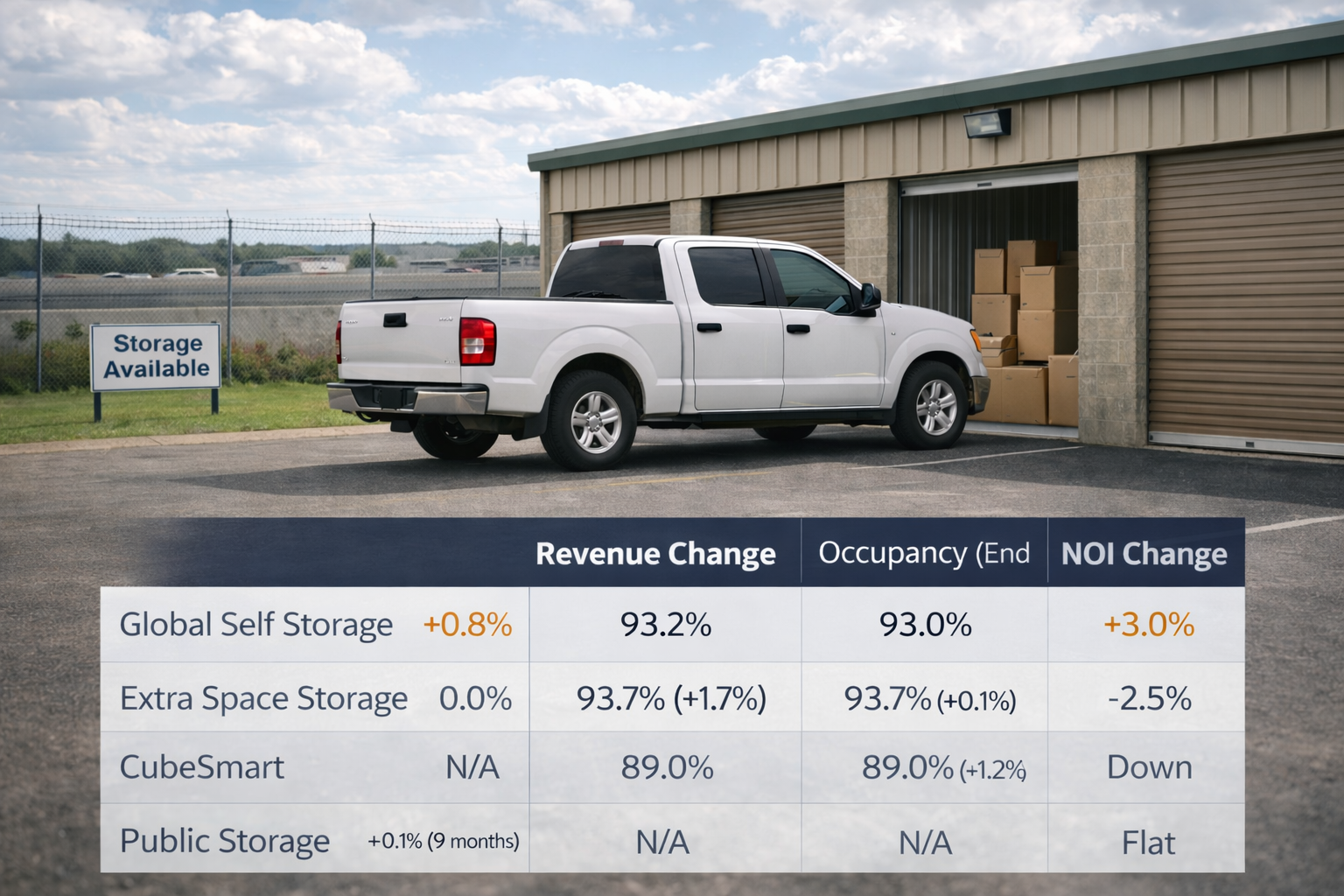

Here’s a simple side-by-side look at Q3 self-storage results:

| Company | Revenue Change | Occupancy End | NOI Change |

|---|---|---|---|

| Global Self Storage | +0.8% | 93.2% (+1.7%) | +3.0% [ir.globalselfstorage] |

| Extra Space Storage | 0.0% | 93.7% (+0.1%) | -2.5% |

| CubeSmart | N/A | 89.0% (-1.2%) | Down |

| Public Storage | +0.1% (9 months) | N/A | Flat |

Global’s store occupancy rate and revenue per square foot stood out. Self-storage REIT performance varied widely in Q3 2025.

CEO Mark C. Winmill said the results show strong marketing and happy customers. Occupancy gains started in November and kept building through quarter end.

He pointed to better space rental rates and higher space utilization. Self-storage NOI margins held firm at Global thanks to smart cost control and digital ads.

The US self-storage sector stayed flat overall in Q3 per Yardi Matrix reports. New supply and soft demand hit occupancy at many chains. Global Self Storage grew revenue and occupancy anyway.

This self-storage operating update proves smaller firms can thrive. They use targeted ads, good service, and tight property management. Bigger self-storage operators faced higher expenses that ate into profits.

Self-storage supply grew fast in 2025, pressuring occupancy at many locations. Global focused on high-demand Northeast markets and kept stores nearly full.

Like-for-like revenue growth came from better occupancy and small rent hikes. Self-storage rental income stayed steady even as new stores opened nearby. Customer retention played a big role too.

The company plans more store buys and builds using its strong platform. Shares rose on the news, showing investor trust in self-storage growth.

Leaders like Global Self Storage set the pace for self-storage expansion in 2026. They mix steady rental income with smart property management to stay ahead of the pack. Self-storage demand looks set to rebound as economic pressures ease.

#globalselfstorage #storageq3 #selfstorage #storage #storagenews